Humor me, can’t avoid inserting a story… In early 2011, a wholesale operator requested me to perform an audit on their recently acquired reservations system. They paid top dollar to a prestigious software provider for it, but six months after implementation, total business volume from retailers was roughly the same as previously recorded figures. While offline traffic remained unvaried, bookings online where not flowing in at all, in spite of a much larger product base available on the system, in relation to their offline catalogue. Their booking engine appeared to be in perfect working order, so what was the mystery, then? Why was there no conversion?

I had to beg the software giant to grant me access to the users’ logs, since there was no such option from my client’s system’s back office. Was the problem spawn by the proverbial retailers’ refusal to adopt new tools? No sir, actually offline requests were a tiny fraction of the total searches in the system. But agents were looking (a lot) for dates, destinations and services not loaded into the system!

Case solved, yet it does not finish there: bear with me, as this telltale brings two lessons… Back then, the only way to fix this was to keep monitoring retailers’ searches (periodically requesting logs from the IT provider), hence loading products and services based on their demand. A reactive solution, though better than nothing, right? I even designed an operational procedure to meet this need. But at the wholesaler nobody did anything, or even paid attention. A ludicrous amount forked out for a top-notch system, my consultancy fee… all for nothing. Unsurprisingly, they went out of business not long after the episode.

If you can’t / won’t read the next thousand words, these are the lessons you can carry with you today:

[ctt template=”3″ link=”NyAlf” via=”yes” ]- Know what your customers are shopping for, then place it before their eyes

– Do whatever data tells you to, or trust your guts until retirement (or bankruptcy)[/ctt]

Find the money leakage!

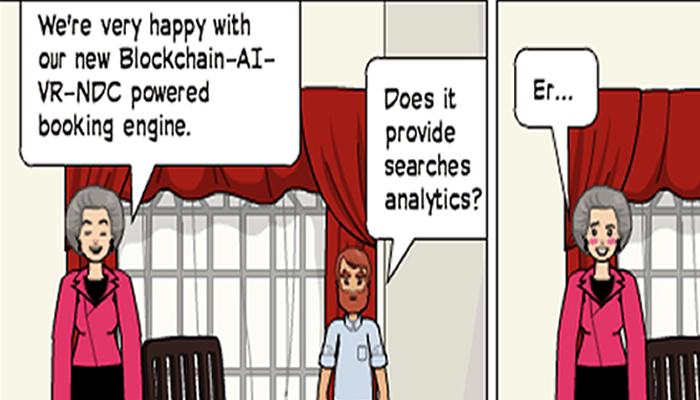

For the life of me, I cannot fathom how come today (seven years after that incident), online reservation systems still fail to provide user search information. ¿Or should I ask, how come operators don’t care about such relevant functionality? Sounds like a “first the hen or the egg?” question, even so it’s a double whammy of a problem. The prestigious software vendor I mentioned in my story is still strong in the market, thus far they don’t provide direct access to searches logs. Knowing how IT companies operate, it means that their operators are not asking for this feature.

No matter who the culprit is, you’re reading this far because you don’t intend to end up as my former client. The first lesson, then, can be reformulated as follows:

[ctt template=”5″ link=”dEaeP” via=”yes” ]Pay close attention to your booking engine’s searches, not only to the confirmed reservations. That way, you’ll have a clear indication of -at least- what your audience is willing to buy.[/ctt]

It’s simply a question of satisfying demand! It’s not that difficult either: ask your IT provider to have a look at your own system’s innards, if that feature is not accessible from back-office. Often logs come in a structured file, so you could study them in a spreadsheet that looks like this:

If you log a few hundred searches per day, a simple spreadsheet might do for your company, but if you’re an OTA or bed bank with thousands (or even millions) of searches per day, you’ll need a tool like REVVA that allows you to easily and quickly visualize profitable events. For instance, a peak in demand over a certain hotel or city in a very specific date span, from a single market or client.

With a solution like REVVA, you could even get automated alerts for this kind of occurrence, however there’s an even more interesting application: demand prediction.

[ctt template=”3″ link=”U1d9f” via=”yes” ]Mixing historic data (old searches) with actual bookings and future-date spans searches, you’ll be able to predict -with notable accuracy- who will buy what, when and for how much.[/ctt]

That’s exactly what we’re doing at REVVA, as it’s not something you can concoct with Excel (nor you should care to). Well, actually you could go DIY, if you had zero budget, few hundred searches per day and used formulae like these:

That’s what we needed a few years ago in the accommodation industry, when there was no automated means to answer business questions like “what would be segment X’s demand for 4 stars hotels in destination Y during period from A to B?”.

A pain in the arse to calculate forecasts like these, even with small datasets, I can assure you.

These days, ask Google about demand forecasts and you’ll find it often associated with terms such as machine learning and econometric models. The reason is that companies with thousands of transactions per day accumulate datasets so huge, that the spreadsheet method is not feasible. Plus, being accuracy a must -for the investments may be rather significant-, a shoddy forecast could bring heavy losses.

To wrap it up:

[ctt template=”5″ link=”qyb_6″ via=”yes” ]Even if you own or manage a travel-related SMB, there is no excuse to dismiss scrutiny over what your customers (be it B2B or B2C) are shopping for in your system, at least on a weekly basis. Not covering their demand is like throwing your hard-earned dosh into the drain. [/ctt]

Act upon the problem!

Once you found the problem, it’s suicidal to leave it hanging there, hoping for it to solve itself. See, after my client closed down, I questioned myself for quite some time, wondering if their demise was inevitable due to inaction and wicked resource management, or if I had a share in their collapse. Hey, it was a well-positioned brand with decades in the market, which survived Internet’s advent… That was the core problem, perhaps: everyone in there was so comfortable doing the same old same, that they failed to realize the market (and the world) was rapidly changing, so my advice was incomprehensible at least. Or just ignored by a couple of forgotten know-it-alls, who vanished in the mist of the industry’s graveyard.

Of course, now I know my consultancy was fatally flawed too. It wasn’t enough to detect a supply/demand issue, nor to provide a written plan to address it. It did cost me yet another similar fiasco to realize my strategy was faulty because it lacked an executor. One of the fundamental requirements to embrace a profitable data-driven culture (see my article on the subject >>) is to assign somebody with data management chores, possibly to oversee completion of whatever task data suggested as well, as if their lives were at stake. Their job certainly is! Be it you, your boss or the bellboy, somebody must analyze and convert data into actionable insights. Sorry for the stupid obviousness I’m about to throw, but actionable insights are not defined as such only to be overlooked! The second lesson to learn by my mistakes (and the long dead operator’s) is this:

[ctt template=”5″ link=”r5nbs” via=”yes” ]Data is gold, your booking engine accumulates a lot of it. If you don’t convert your idle data into business value through action, you’re wasting money. Probably truckloads of it.[/ctt]

Go on, fix that leakage right now!

In case you’re pondering if all this is applicable to your situation, just ask yourself the question that titles this article. Have you got a booking engine? If you do, of any kind, for whatever travel business, you’ll certainly benefit from the two lessons contained in this text. So please get away from that screen and start immediately to examine your own logs. Try to discover who your customers actually are (buying personas), where their preferences are aimed at (buyer habits) and how much is in their wallet (buying power). Remember segmentation? Find more here >>, if you don’t own the concept yet.

Every minute you procrastinate this analysis, you lose a few cents. Every day, instead, might mean hundreds or thousands of your local currency lost in revenue!

As you surely anticipated, these ideas are valid for small independent hotels as much as global chains, for regional airlines as much as OTAs, for incoming operators as well as package resellers… I’ve been providing free assessments to small operators all over the world, so if you’re struggling with this kind of troubles, don’t be shy and reach out to me (no strings attached, I love to help for the sake of it). Just don’t wait to be too late to save your company!

On the other hand, if a reader has experience in overcoming these data obstacles, I’d love to hear how they did it in their organization. I would really hate to appear as a pompous lecturer to professionals with a lifetime in the business, but then again it greatly surprises me to find out that multi-million worth operators are not even storing their valuable data, lest scrutinize it. I couldn’t help but notice that quite an audience from Accor, Marriott, Amadeus and Hotelbeds read (and even liked) my latest posts: can any of you nice people step forward and teach us how it’s done in a colossal company like yours?

Thanks for reading, commenting and sharing!

Marcello Bresin

Comments

2 responses to “Got a booking engine? Probably you’re losing money”

Well researched and thoughtful.. It clearly paves the way for data which is in today’s term is more valuable than gold or fuel.. Really appreciate @marcello to bring this forward in such an simple but effective manner.

Thanks a lot, Rachit! Your feedback is greatly appreciated, being an expert in the field. All the best!