A question of survival

Years ago, an independent hotelier posed the same question to me, only linked to the accommodation business. I couldn’t believe my ears at the moment; since then I learnt that, although news and buzzwords travel fast in our industry, actual comprehension and implementation of new things slows down to a sluggish crawl.

Nonetheless, hoteliers were fast in adopting rate comparison systems, because they saw how the big chains were eating up entire market portions, and OTAs were starting to dominate the landscape. These days, no hotel can survive for long without periodically and methodically checking their “competitive set” (google “compset” if you’re not familiar with the term).

Tour operators, on the other hand, generally have minimal ongoing costs compared with hotels, as a consequence they were taking it easy so far…. TOs seem to be blind to the fact that they do have wasted “inventory” too, products and services not sold and lost forever. If charter seats were signed up, if guaranteed allotments were negotiated: how do you call that? If a DMC owns a 20-seater minibus which leaves for a tour with only half its capacity filled up: how do you call that?

In contrast, both incoming and outgoing operators are fully aware of their competition, no doubt. Can you see the nexus between inventory not sold and pricing? Please, don’t get me wrong: I’m not patronizing here, and if you’ve come this far with your business, certainly it isn’t because you’re dumb. But modern psychology (not me!) states that your mindset might be still rooted in the paper brochure days, while consumers shop around at the speed of their 5G/1TB optic fiber connections.

In short:

As a tour operator, you need rate comparison systems because you must benchmark your offerings against the market and your competitors, in order to sell more.

A plain and simple survival device.

What are and how do RCS work

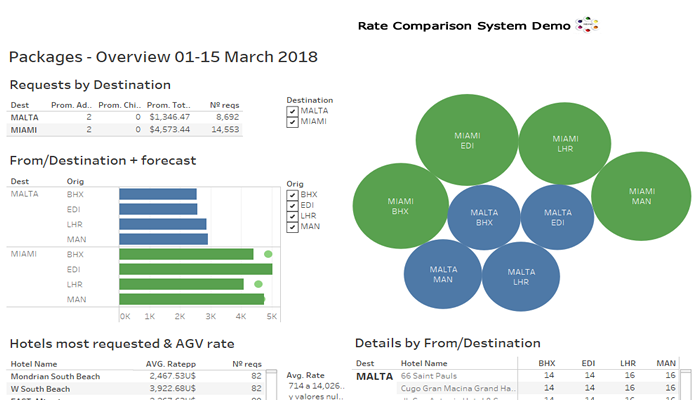

Tripadvisor, Kayak, Skyscanner et all are RCS, of course, only for consumers. Such sites pick price data -in a supposedly ethical manner- from several sources and order findings based on product, destination, departure date, etc., to help consumers find better deals. For proper professional benchmarking though, even if the principles in data collection are more or less the same, a different kind of tool is in order. You can’t be manually searching and comparing dozens of prices in several websites to analyze pricing trends, can you? There are several systems that bring specific air, accommodation and package B2C rates compared by market, product, dates and even single competitors (a B2B comparison system is in the works…stay tuned). That’s a rather large amount of data to be analyzed manually, hence a BI tool like REVVA >> can save considerable chunks of time and money, aside from streamlining an otherwise complex process.

Fine, but what do TOs actually get from these RCS?

01 – Sell more and increase market shares

Wouldn’t this be sufficient to start immediately benefiting from tools like these? Wait, I want to be totally transparent here: rate comparison is not enough to obtain massive competitive advantage. But it is the main component of a dynamic pricing strategy, which in turn is an important part of a revenue management strategy. This is in fact the first of a series of articles I’ll be publishing regarding these closely interrelated subjects. Stay tuned!

02 – Keep your competitors at bay

To identify where you stand in terms of pricing and production against your competitors is paramount, you know that very well. As mentioned above, most consumers tend to buy online now (being mobile bookings a fast-growing trend), so you’d better be a step ahead your competitors, or you’ll be leaving a lot of money on the table (for them to collect). You might argue: what about those operators who don’t publish their rates online? Well, I wouldn’t worry much about them, for they won’t be competitors in the long run… the very reason being the same I pointed out above: faster and smarter consumers don’t have time to find out how much you sell this or that package, clicking through pages and filling up forms. Don’t commit the same mistake, because only the filthy rich don’t care about prices, and I am ready to bet they’re not among your target segments.

03 – Know your market inside-out

Sure enough, you’ve been around for so long that you developed a sixth-sense to detect market shifts and peaks… That’s commendable and I guess it works for you most of the time. Haven’t you noticed, though, that your predictions are a bit less reliable every season? It’s not you, it’s the bloody internet. I’m not saying that you shouldn’t trust your gusts, I just suggest that you complement them with data. Once I used to think I had the market uber-vision superpower too, but in the past few years I came to realize that shifts and peaks happen overnight, or even faster. Today, I’d rather confront my experience with data-driven analytics, before taking any pricing decision. Otherwise, the risk of being out-of-market (by excess or defect) is too high, and nobody can afford it in the current hyper-competitive environment.

04- Calibrate your positioningHaving accurate references for maximum and minimum prices will allow you to define your own price elasticity. Because you’re not selling all year long at the same price, are you? And I don’t mean just increasing rates 15-20% in the three-month high season…

05 – Better pricing strategy

May I ask how do you calculate your retail prices? Most probably it’s designed seasonally, cost-based and segment-oriented, with an eye on competition’s rates. Hey, that was the only way to do it before computers came around! Now it only makes sense to price your stuff based on demand. That’s why you’re selling in the first place, right? You sell because you detected there’s a certain demand for your products and services, but obviously demand is fluctuating due to many factors. These days it is rather easy to analyze, determine and anticipate demand trends with tools like RCSs and REVVA. With such information available, the next step would be adopting a strategy to adjust or increase rates based on demand: competition crushed, higher profits and stronger contracting power are among the results obtainable, time and time again in a profitable virtuous circle.

06 – Incentivize loyalty

Consumers sense that if an operator brings value, it must also offer competitive prices (and vice-versa). It is obvious that knowing your market means having a perfectly clear picture of who your customers are, as much as your competitors. Therefore, with a proper pricing strategy you’ll be sending the right message to your perfectly crafted target segments, who will be likely buying again from you. While this is true for every kind of business, I’d say it’s even truer for holiday traders.

07- Spot opportunities or problems

It may be a general increase in rates for a certain date, a surge of offerings for a certain destination… If you keep the pricing trends under control with your “peripheral vision” (or with automated alerts that let you know about any divergence from normal state of affairs) you’ll be able to anticipate and counter rivals’ strategies, eroding away even more of their market share. Sheesh, I am starting to feel sorry for them…

08 – Get the most out of your marketing campaigns

If all of the above is in place and you devised a good strategy (how could you not?), higher conversion rates and sales are guaranteed to be achieved, because marketing campaigns will be laser-targeted. No more money wasted on pointless advertising!

Actually, I could provide a few more whys and wherefores about RCS necessity, although those would be sub-reasons strictly correlated with dynamic pricing and revenue management… which will be the matters I’ll address in my next articles.

If this series is interesting to you, subscribe to our newsletter for updates.

Thanks for reading!

Marcello Bresin